As concluded in the first part of this series, defining the organisation’s portfolio, and the allocation of resources across it, is one of the most important strategic decisions senior executives make. A rich set of portfolio initiatives must be considered, and alignment of those initiatives to the organisation’s strategic objectives must be assessed. Ultimately a set of initiatives must be selected that strikes a balance across competing objectives and risks to delivery of the portfolio. This is the purpose of the Portfolio Definition cycle.

This is part 2 of a 6-part series. In this Insight we explore how to apply Decision Science to Portfolio Definition in a way that is consistent with the Management of Portfolios (MoP®) guidance.

Applying the rigour of Decision Science – through MCDA and Decision Conferencing

Multi-Criteria Decision Analysis (MCDA) is a discipline derived from Decision Science, an active field of development since at least the 1960s, initially at Harvard and MIT and in the UK at the London School of Economics (LSE). Catalyze was founded in conjunction with the LSE in 2001. MCDA helps inform decisions where multiple factors need to be considered. It can be applied to anything that an organisation could choose to do or not to do – from projects and programmes to products and services. It can be used to make a one-off decision, such as where to locate a factory, or to prioritise a large portfolio of projects and programmes. MCDA is used to evaluate the initiatives and order them from the most preferred to the least preferred, taking into account hard and soft benefits, costs and risk.

Initiatives will differ in the extent to which they meet several criteria, and it is unlikely that one initiative will be most preferred with respect to all of them. Criteria can include a mixture of quantitative and qualitative factors and will often conflict with one another. For example, a car that is bigger or more attractive might be more expensive to buy; one that is cheaper to buy might be less fuel efficient and costlier to run; and a car that is faster might be less safe. These competing objectives mean trade-offs are required when making decisions.

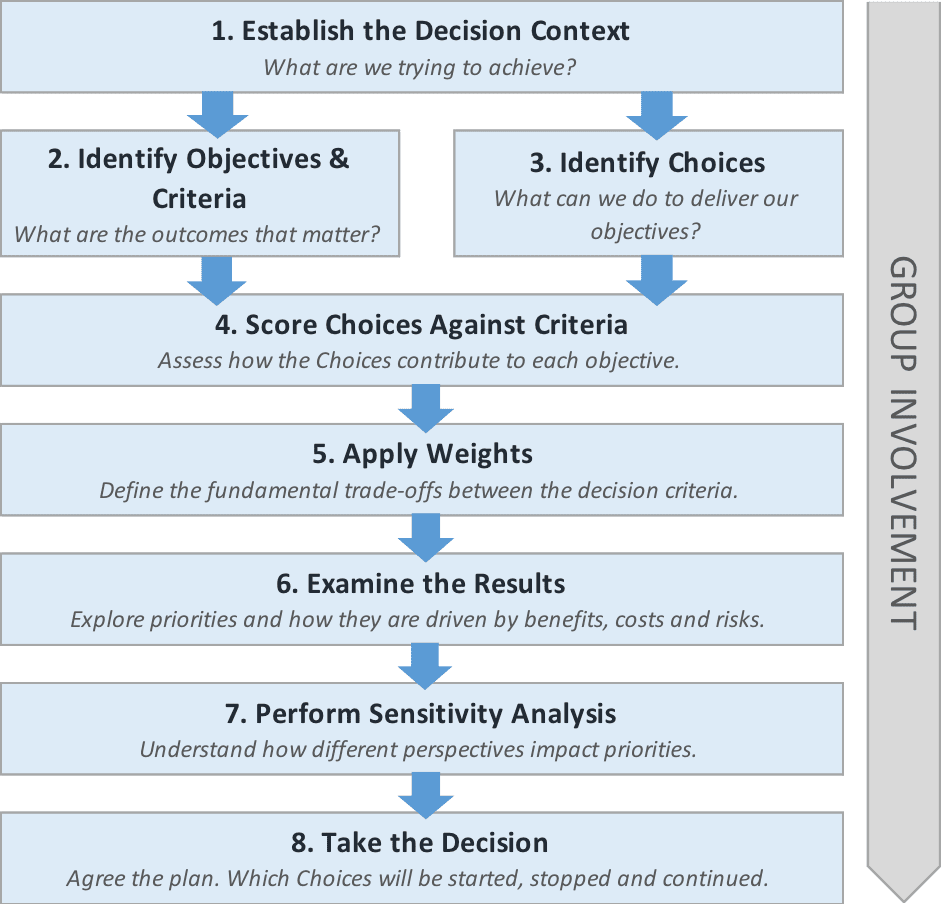

MCDA is a business process that allows a problem to be broken down into manageable pieces and for data and judgements to be applied coherently before the elements are reassembled to present an understandable overall picture to decision makers.

In Portfolio Definition, MCDA enables the most effective and insightful allocation of limited resources (e.g., costs, people and management effort) across a number of activities, projects, programmes and initiatives. It seeks to achieve the best value-for-money, balancing across competing objectives and risks, and to encourage innovation. An internationally recognised way of applying the rigour of MCDA is through Decision Conferencing, the two combining to create a ‘socio-technical’ process.

Decision Conferencing involves a series of independently facilitated, intensive working meetings, called Decision Conferences, attended by decision makers, stakeholders, and advisors with a direct interest in the subjects under discussion. The ‘chair’ should be the senior decision maker. Decision Conferences are conducted as live, working sessions, typically lasting one or more days.

A unique feature is the use of an MCDA Model, which incorporates both data and the judgements of the participants in the group. The Model provides ample scope for representing both the many conflicting objectives and opinions expressed by participants, and the inevitable uncertainty about future consequences. Catalyze, with the LSE, has developed Models for this purpose that are strictly compliant with accepted MCDA principles.

The Model is a ‘tool for thinking’, enabling participants to see the logical consequences of differing viewpoints, and to develop higher-level perspectives on the issues. Participants develop a shared understanding of the issues, a sense of common purpose and are more likely to reach agreement about the way forward and remain committed to the decisions (getting the decision to ‘stick’). The aim is to achieve better, faster decisions and, in so doing, improve the performance of management teams.

In the next article we look more closely at Understand, Categorise and Prioritise steps in the MoP® Portfolio Definition Cycle through the lens of Decision Science.

Recent Comments